Default Prevention and Management Policy 2013

Table of contents

- Effective Date

- Application (Who is covered by this policy?)

- Policy Statement (What is the policy designed to achieve?)

- Context (Why this Policy matters?)

- Policy Requirements (How will the policy results be achieved?)

- Emergency Situations

- Consequences (What happens when significant issues arise under this policy and directives?)

- Enquiries

- Appendices

- Appendix A: References (What other policies and directives are relevant?)

- Appendix B: Definitions

1.0 Effective Date

This policy takes effect November 2013.

2.0 Application (Who is covered by this policy?)

This policy applies to Aboriginal Affairs and Northern Development Canada (AANDC) and Health Canada (HC) (hereafter referred to as the department(s)) officials managing transfer payments. This policy does not apply to funding provided under legislated self-government agreements and funding agreements resulting from federal-provincial accords.

This policy is based on the implementation of the Policy on Transfer Payments (2008), setting out the policy framework for the department(s) default prevention and management activities based on risk management and assessment to assist recipients to be proactive in addressing Program and/or financial management and capacity challenges.

This policy replaces the Default Prevention and Management Policy dated June 2011 and is issued under the authority of the Chief Financial Officer (CFO).

3.0 Policy Statement (What is the policy designed to achieve?)

3.1 Objective

The objective of this policy is to:

- support community capacity development so that communities continue to increase their ability to self-manage and prevent default and default recurrence;

- assist recipients, where possible, in preventing defaults of funding agreements;

- assist recipients, where possible, in their timely management and remediation of defaults;

- maintain continuity in the delivery of departmentally funded Programs to Aboriginal communities while the recipient is in default;

- meet the requirements for departmental accountability, transparency, and effective internal control in the management of departmental transfer payment Programs; and

- support the harmonization of transfer payment programs within the department(s), and ensuring collaboration with other departments.

3.2 Expected Results

The expected results are:

- enhanced sustainability in the delivery of Programs by recipients through minimization of default;

- early identification and prevention of potential recipient defaults, reducing the occurrence and severity of defaults through monitoring and compliance reviews;

- improved identification of the concerning situation to allow the department(s) and the recipient to find remedies that respond to the nature of the problem and that are less intrusive;

- to ensure sufficient records of decisions are documented during the default prevention and management process;

- increased capacity of recipients to remediate defaults in a manner that is timely and reflective of the complexity of the default and reflective of the community needs and priorities; and

- recipients effectively addressing the causes of their defaults.

3.3 Defaults

A default is specified in the funding agreement and may include:

- the recipient defaults on any of its obligations set out in the current funding agreement, a prior agreement, or in any other agreement through which a federal department(s) funds the recipient;

- the auditor of the recipient gives a disclaimer of opinion or adverse opinion on the audited consolidated financial statements of the recipient in the course of conducting an audit pursuant to a funding agreement;

- in the opinion of the department(s), with regards to any financial information relating to the recipient and reviewed by the department(s), the financial position of the recipient is such that the delivery of any program, service or activity for which funding is provided under the funding agreement is at risk;

- in the opinion of the department(s), the health, safety or welfare of the Aboriginal community is at risk of being compromised; or

- in the case of an incorporated recipient, the recipient becomes bankrupt or insolvent, goes into receivership, takes the benefit of any statute from time to time being in force relating to bankrupt or insolvent debtors, or ceases to be in good standing with whichever federal or provincial jurisdiction in which the recipient was incorporated.

4.0 Context (Why this Policy matters?)

The department(s) recognizes the importance of continued, uninterrupted provision of programs and services for the health, safety and welfare of Aboriginal community members. This policy sets a three part approach of default prevention, default management and sustainability to facilitate the effective management of defaults.

Key principles of the approach involve:

4.1 Default Prevention

Where possible, developing recipient capacity and/or funding programs targeted to capacity development for effective program delivery to Aboriginal community members by:

- supporting demand driven capacity development in Aboriginal communities in a sustainable manner;

- assist and support recipients, where possible, in addressing situations that could give rise to a default under a funding agreement;

- promoting capacity development within Aboriginal institutions and organizations to work with Aboriginal communities on their capacity gaps; and

- promoting community mentoring and linking communities with expertise to those with capacity gaps.

Recognition of community identified needs and priorities and their role in default occurrence, as well as default prevention and sustained self-management.

4.2 Default Management

- Where a default occurs, support effective recipient management of the default with a flexible range of strategies that is as least intrusive as possible and that will assist recipients to address the default situation based on timelines agreed to by the recipient and the department(s); and

- transparency to Aboriginal community members through disclosure of the General Assessment and/or Management Action Plan.

4.3 Sustainability

Identifying to recipients areas of capacity development that may enhance sustainability and reduce the occurrence of future defaults.

These principles of Default Prevention, Default Management and Sustainability are enabled through a process where:

- recipients remain responsible and accountable for compliance with the terms and conditions set out in the funding agreement including effective management and use of resources involved, preventing defaults, and remediating and recovering from these defaults in a timely manner when they occur;

- the department(s) provides funding to recipients in accordance with the terms and conditions of funding agreements, reviewing the recipient's accounting for the appropriate use of the funds provided, and in applying this policy and related directives as appropriate;

- the department(s) strives to develop and maintain a co-operative relationship with recipients to enhance the capacity and financial health necessary for sustainable, efficient and accountable delivery of Programs;

- the department(s), where possible, will strive to ensure incidents of defaults known to the department(s) are clearly communicated to the recipient;

- use of Management Development Plans will be strongly encouraged for preventing potential defaults;

- the department(s), where possible, will strive to make default management progressive, flexible and implemented in a manner which allows the recipient the opportunity to address the default; and

- the department(s), where appropriate, will allow default management to be, on a program specific basis to insure the action taken is reasonable, cost effective and proportionate to Program risk.

Achievement of the objectives and expected results of this policy relies on an integrated approach involving effective default prevention, default management and sustainability processes, specialized Recipient-Appointed Advisors who the recipient will monitor for performance, and capacity development resources available within departmental Programs.

5.0 Policy Requirements (How will the policy results be achieved?)

5.1 Responsibilities (Who does what under this policy?)

The Deputy Ministers are responsible for:

- ensuring that the department(s) has the capacity to implement and oversee this policy; and

- ensuring that controls are in place to manage recipient defaults in a manner that is cost effective and proportionate to program and recipient risks.

The Chief Financial Officer, in their respective departments, are responsible for:

- providing oversight on the implementation of this policy including investigating and acting when significant issues arise regarding policy compliance;

- administering this policy by providing interpretation, guidance, tools, training, and by maintaining a roster of pre-qualified Third Party Funding Agreement Managers; and

- conducting annual assessments of the application of this policy, and providing an annual report for senior management review (in AANDC, the Operation Committee), which will include a status report of all recipients in default, and which will reflect the case management approach being taken to reduce the number and severity of defaults.

Assistant Deputy Ministers are accountable for:

- implementing this policy for operational purposes; and

- monitoring the application of the Default Prevention and Management Policy within their respective Sectors and reviewing the nature and frequency of defaults, to identify cross-cutting issues and to define priorities for improvements.

Regional Directors General, Directors General, and Regional Executive Officers are accountable to their Assistant Deputy Ministers for:

- establishing procedures to operate the Default Prevention and Management Policy, including default prevention, default management functions and sustainability;

- ensuring oversight and compliance with the policy, including the establishment of a governance committee charged with transfer payments management;

- monitoring operations through quarterly and annual reports, and by supporting audits and evaluations, and taking corrective action when needed;

- maintaining files in the Grants and Contributions Information Management System (GCIMS);

- approving the use of Third Party Funding Agreement Management, where required, in a manner that is consistent with this policy; and

- implementing appropriate communications to support operations under the DPMP.

Funding Services Directors (FSDs) or their equivalents are responsible for:

- maintaining relationships with recipients, consistent with funding agreements, that will support the effective operation of this policy, including default prevention, default management and sustainability functions;

- monitoring recipient management of funding agreements, and being alert for extraordinary events that have the potential to impact funding agreement performance;

- supporting sustainability and default prevention measures as described in this policy, including informing recipients where there appears to be a potential for default to occur and when there is a need for corrective action;

- coordinating administration of default management action(s); and

- maintaining files, in accordance with departmental standards, including the timely updates to the system of record, such as the GCIMS.

5.2 Approach

This policy will support the delivery of Programs through a three part approach which includes:

- default prevention,

- default management, and

- sustainability.

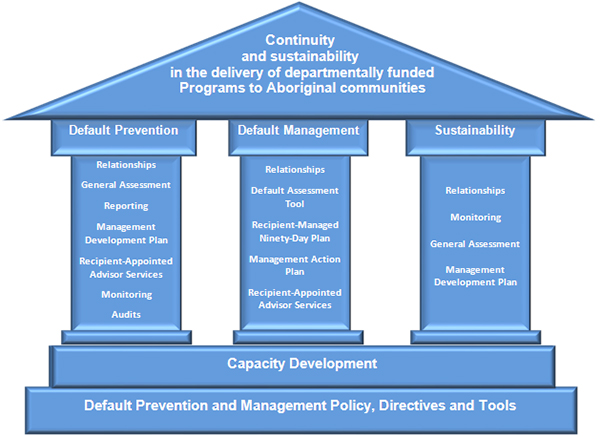

Figure 1 outlines some of the tools and resources available for each approach.

Text description of Figure 1

The following is a text description of the image that depicts the three part approach by which the Default Prevention and Management Policy will support the delivery of programs and services.

Described: a 3-column/pillar structure, representing each part of the 3-part approach of prevention, management, and sustainability set by the Default Prevention and Management Policy.

The structure comprises 4 parts:

- Triangle-shaped Roof;

- Three vertical rectangles representing pillars supporting the Roof;

- A rectangle representing the Floor; and

- A rectangle representing the Foundation.

The Foundation represents the base of the approach to facilitate the effective management of defaults. The tools and/or instruments are the policy, directives, and guidelines. The Foundation is labelled Default Prevention and Management Policy Directives and Guidelines.

The Floor is labelled Capacity Development.

The 3 Pillars are labelled as follows:

- Default Prevention, as the header, and sub-headers are labelled:

- Relationships

- General Assessment

- Reporting

- Management Development Plan

- Expert Resource Pools

- Monitoring

- Audits

- Default Management, as the header, and sub-headers are labelled:

- Relationships

- Default Assessment Tool

- Management Action Plan

- Management Development Plan

- Expert Resource Pools

- Sustainability, as the header, and sub-headers are labelled:

- Relationships

- Monitoring

- General Assessment

- Readiness Assessment

- Management Development Plan

The Roof represents the overall goal of Default Management and is labelled: Continuity and sustainability in the delivery of AANDC funded programs and services to Aboriginal communities.

5.2.1 Default Prevention

The department(s), through ongoing review of information available about the recipient's management of funding and through other strategies, will, to the extent possible, assist recipients in their efforts to prevent the occurrence of circumstances that may give rise to defaults. Such assistance may include, but may not be limited to:

- providing detailed explanation/analysis of the department(s') General Assessment to assist recipients in identifying circumstances that may lead to default;

- listening to communities that have identified needs and priorities and responding to these in a manner that enables capacity development and increases their ability to self-manage effectively;

- the application of a proactive approach which includes early identification and tracking of the causes or deterioration of a concerning situation that may lead to a default and that will strengthen the community's ability to improve their accountability processes, administrative and financial systems;

- strategic use of Recipient-Appointed Advisor services to address the causes of defaults, and identify and develop necessary capacity to prevent the occurrence of circumstances that may give rise to a default; and/or

- assisting with identification of capacity development actions and resources available to develop a voluntary Management Development Plan (MDP) targeted at increasing recipient capacity and preventing defaults.

5.2.2 Default Management

Notwithstanding the best intentions of recipients to prevent the occurrence of default, defaults may occur. The Directives on Default Prevention and Management and Third Party Funding Agreement Management contain details for the default management process. This process, through the use of departmental tools and resources, will support the recipient in addressing their default. The process is a continuum of default management that includes active monitoring of the situation, requiring the recipient to develop and implement a Management Action Plan or a Recipient-Managed Ninety-Day Plan, and/or the employment of Recipient-Appointed Advisors.

Subject to the terms and conditions of the funding agreement, the appropriate departmental official may take any one or more of the following actions once a default has been identified:

- for minor defaults, require the recipient to develop and implement a Recipient-Managed Ninety-Day plan within thirty (30) calendar days;

- require the recipient to develop and implement a Recipient-Managed Management Action Plan within sixty (60) calendar days;

- in higher risk cases, the department(s) may require the recipient to engage a Recipient-Appointed Advisor services from individuals or organizations acceptable to the department(s);

- withhold any funds otherwise payable under a funding agreement;

- require the recipient to take any other reasonable action necessary to remedy the default;

- take such other reasonable action(s) as the department(s) deems necessary;

- in the highest risk cases, the department(s) may appoint, upon providing notice to the recipient, a Third Party Funding Agreement Manager; or

- terminate the funding agreement.

When deciding what measures to take, the official must, to the degree that is prudent in the circumstances:

- take into account the risks and circumstances associated with the default;

- the degree of co-operation between the recipient and the department(s);

- the willingness and ability of the recipient to remedy the default;

- ensure the default management is progressive in nature and the least intrusive; and

- allows the recipient the opportunity to remedy the default before its level is escalated.

Defaults will not automatically result in the need for formal measures.

These measures and the processes related to them are described in greater detail in the Directives on Default Prevention and Management, Third Party Funding Agreement Management, Financial Reporting and Reporting Management.

Defaults in reporting resulting in halted funds will be subject to the Directives on Financial Reporting and Reporting Management and the Management Control Framework that is programmed within the Grants and Contributions Information Management System (GCIMS).

The appointment of a Third Party Funding Agreement Manager would be instituted as a last resort to ensure the continued delivery of Programs to community members.

5.2.3 Sustainability

Sustainability measures are to:

- mitigate residual risks that leave the recipient vulnerable to circumstances that may give rise to future defaults;

- help address capacity gaps in the recipient's community where applicable; and

- enhance the recipient's management and Program delivery capabilities.

The department(s) will work within the Community Development Framework with the recipient and other partners where feasible to support capacity development and identify and appropriately apply available resources to help re-establish sustainable Program delivery and prevent the recurrence of circumstances that may give rise to future defaults.

5.3 Tools

The following is a list of the main tools and resources that may be used to implement this policy (please refer to appendices for definitions):

- the General Assessment (GA)

- Management Development Plan (MDP)

- the Governance Capacity Planning Tool (GCPT)

- the Default Assessment Tool (DAT)

- Management Action Plan (MAP)

- Guide on How to Select a Recipient-Appointed Advisor

- Capacity and Community Development Programs

6.0 Emergency Situations

Where a default is associated with a local emergency as declared by federal, provincial or territorial authority, the departmental officials may expedite the default management processes where it is evident that an urgent response is required to manage the risk of severe negative impacts. Communication must be maintained with the recipient without limiting any action the department(s) may take under the funding agreement.

7.0 Consequences (What happens when significant issues arise under this policy and directives?)

Consequences of non-compliance with this policy and its supporting directives, or of failure to take corrective actions that may be requested by the CFO, may include reporting to Senior Management, requiring additional training, changes to procedures and systems, the suspension or removal of delegated authority, disciplinary action, and other measures as appropriate.

8.0 Enquiries

For enquiries and interpretations, please contact (as applicable):

9.0 Appendices

Appendix A: References (What other policies and directives are relevant?)

For enquiries and interpretations, please contact (as applicable):

- Treasury Board Secretariat: Policy on Transfer Payments (2008)

- Treasury Board Secretariat: Directive on Transfer Payments (2008)

- AANDC: Management Control Framework for Grants and Contributions

- AANDC: Directive on Default Prevention and Management

- AANDC: Directive on Third Party Funding Agreement Management

- AANDC: Directive on Financial Reporting

- AANDC: Directive on Reporting Management

- AANDC: Directive on General Assessment

Appendix B: Definitions

The definitions below are meant to be applied in all documents found in the Default Prevention and Management Policy suite.

Allegation: may include, for example, the misuse or misappropriation of departmental funds, fraud, collusion or gross mismanagement. If criminal activity is involved, the matter would be referred to the appropriate policing authority.

Asset Based Lending: Financing [that advances credit] secured by a firm's balance sheet assets, such as inventory, receivables, or collateral other than real estate.

Case Management: on a risk-managed basis, the department(s) takes a proactive approach to managing the more severe cases of default that include enhanced oversight and other measures, as appropriate.

Capacity and Community Development Programs: programs that are available periodically to enhance the recipients and its community's capacity to deliver programs and services.

Community Development Framework (Health Canada/Aboriginal Affairs and Northern Development Canada): the Framework describes an approach to community development in Aboriginal communities that is intended to facilitate the improvement of individual and collective outcomes, well-being and quality of life in Aboriginal communities. The approach is investment based and responds to the needs of community developed and owned plans while providing access to a broad array of capacity programming from as many departments as possible.

Complaint: involve actions or inactions which are potentially non-criminal in nature. For example, these may include a First Nations member on-reserve who cannot obtain funding for house repairs or for post-secondary education and who believes the process was unfair.

Conflict of Interest: a situation in which an individual has private interest that could improperly influence the performance of his or her official duties and responsibilities or in which the individual uses his or her office for personal gain.

Debt-Service Coverage: the ratio of cash available for debt servicing to interest, principal and lease payments.

Default Assessment (DA): A structured business process used to determine if a recipient is in a default situation and includes:

- the risk to the service population;

- the risk to (successful) remediation;

- the overall default management risk rating; and

- a recommended action — informed by the overall risk rating and assessed, by the responsible official, as a reasonable way to proceed

Default Assessment Tool (DAT): a standardized business process that identifies the level of risk of a recipient default and aids the department(s) in deciding the appropriate default management action based on capacity/performance, willingness and the risk of the recipient to deliver programs.

Default Management (DM): The process for identifying and managing defaults of a funding agreement.

Default Prevention: is an ongoing process that focuses on the relationships with funding recipients and is inherent in existing departmental business processes.

Emergency: a present or imminent event that requires prompt coordination of actions concerning persons or property to protect the health, safety or welfare of people, or to limit damage to property or the environment. (Quoted from the Emergency Management Framework for Canada).

Financial Health: The financial position of the recipient as determined through the department(s') financial assessment process such that programs funded by the department(s) are not at risk.

Funding Agreement (FA): A written agreement between the Government of Canada and a recipient that sets out the obligations or understandings of both parties with respect to transfer payments.

General Assessment (GA): A standardized process for assessing a recipient for the purpose of identifying potential issues that may impact delivery of departmentally-funded programs; and for adjusting administrative requirements in proportion to that risk, such that the funding agreement is managed within the department(s') risk tolerance.

Governance Capacity Planning Tool (GCPT): A tool that allows First Nations and Inuit communities create a community-focused, long-term plan for governance capacity development.

Grants and Contributions Information Management System (GCIMS): A web-enabled system that automates the department(s') transfer payment business processes, manages funding agreement information, and provides on-line access for First Nations and other funding recipients.

Guide on How to Select a Recipient-Appointed Advisor (RAA): tool that assists departmental officials and recipients in the search and selection of a Recipient-Appointed Advisor to aid in relation to default prevention, default management, and sustainability.

Management Action Plan (MAP): A plan developed by the recipient and acceptable to the department(s) which reflects measures to be taken to address a default. The MAP addresses root causes of default and prevents a recurrence of the default. The MAP is also used to identify capacity gaps and resources available for successful implementation.

Management Development Plan (MDP): A plan developed and approved by the recipient and accepted by the department(s), which addresses any recommendations identified in an assessment of the recipient's administrative, accountability and management. The MDP may also be used to meet requirements for de-escalation from a Management Action Plan (MAP).

Non-Asset Based Lending: Lending that excludes asset based lending.

Primary Default Management Strategy: a potential outcome to the Default Assessment that is the requirement for: a Management Action Plan (MAP); a Third Party Funding Agreement Management; or a Termination of Agreement. The Primary Default Management Strategy may be adjusted by the Delegated Authority.

Program: A group of related activities that are designed to meet a specific public need and are often treated as a budgetary unit. A program can be a project or a service.

Project: an undertaking having an importance and level of complexity which warrants establishing a plan and management regime in order to ensure the objectives are met within specified time, cost and quality standards.

Recipient: An individual or entity that either has been authorized to receive a transfer payment or that has received that transfer payment.

Recipient-Appointed Advisor (RAA): a person or organization hired by a recipient to assist and facilitate in the development and/or execution of any aspect of the Management Action Plan.

Recipient-Managed Ninety-Day Plan: a plan developed by the recipient, acceptable to the department(s); details the actions, responsibilities and timelines for the remediation of the default.

Responsible Official: A departmental official responsible for the determination of levels of default for a recipient. The responsible official for invoking Third Party Management is a Director General or equivalent level official.

Risk: future events or situations that may have a positive or negative impact on the achievement of the objectives of the Funding Agreement.

Risk Mitigation: the means by which risk may be managed to realize opportunity and avoid negative impacts.

Risk Profile/Score: the results obtained by comparing information on a recipient to a series of benchmarks that describe, low, medium and high risk situations. Each result is assigned a numeric score.

Risk Rating: a measure of the risk faced by a recipient in managing a Funding Agreement, determined by aggregating the scores within the risk profile. Ranges of numeric risk scores are rated "low", "medium" and "high".

Risk to Service Population: the results of a structured process to assess the actual or potential impacts arriving from a default situation on the health, safety and well being of the service population or on community assets; and the urgency for action to mitigate those impacts.

Risk to Remediation: the result of a structured process to assess the likelihood that a recipient is able to self-correct a default situation, in terms of its performance/capacity and willingness to do so.

Risk Tolerance: the performance/capacity or willingness of the parties to the Funding Agreement to accept risk, and which may differ between the parties and vary over time.

Stakeholder: a participant in the remediation management process with a stake in the timely and effective resolution of the default and the restoration of program delivery and/or the establishment of sustainable operating conditions for the recipient. This may include the department(s), the Aboriginal community, the recipient's council, other federal departments, etc.

Sustainability: is an ongoing process that focuses on addressing capacity gaps in the recipient's community to prevent future defaults.

Third Party Management (TPM): A default management action applied by the department(s) in high risk situations, whereby the department(s) appoints a Third Party Funding Agreement Manager to manage some or all of the funding under a funding agreement for a period during of time which the recipient works to address the underlying causes of the default and reassume responsibility for the funding agreement.

Third Party Funding Agreement Manager (TPFAM): A prequalified third party, appointed by the department(s), that administer(s) Program funding otherwise payable to the recipient and the recipient's obligations under a funding agreement, in whole or in part, and that may assist the recipient to address defaults under a funding agreement.

Third Party Funding Agreement Management Action Plan: a plan prepared by the Third Party Funding Agreement Manager within 60 days of its appointment, setting out an assessment of the recipient circumstances and a course of action for the Third Party Funding Agreement Manager and the recipient during Third Party Funding Agreement Management. See the Third Party Management Framework Agreement.

Third Party Management Framework Agreement: The Third Party Management (TPM) Framework Agreement governs a variety of TPM services that may be required and called upon under Canada's funding agreement with First Nations and First Nations Organizations. It is very much like a standing offer.

Transfer Payment Management Committee (TPMC): A committee established within a region or sector, with governance responsibilities, to oversee the default assessment process, to approve draft default assessment reports and accept the Management Action Plan(s), MAP(s), within their area of responsibility.