Directive 205: Default Prevention and Management

Table of contents

- 1.0 Effective Date

- 2.0 Application (Who does this directive apply to?)

- 3.0 Directive Statement (What is the directive designed to achieve?)

- 4.0 Context (Why does this directive matter?)

- 5.0 Directive Requirements and Responsibilities (How will the desired directive results be achieved and who does what under this directive?)

- 6.0 Oversight and Internal Controls

- 7.0 Consequences (What happens when significant issues arise under this directive?)

- 8.0 Enquiries

- 9.0 Appendices

1.0 Effective Date

This directive takes effect November 2013.

2.0 Application (Who does this directive apply to?)

This directive applies to Aboriginal Affairs and Northern Development Canada and Health Canada (hereinafter referred to as the department(s)) officials managing transfer payments. This directive does not apply to funding provided under legislated self-government agreements and funding agreements resulting from federal-provincial accords.

3.0 Directive Statement (What is the directive designed to achieve?)

3.1 Objective

The objective of this directive is to aid in the implementation of the Default Prevention and Management Policy through departmental processes which identify defaults. The Default Prevention and Management Policy mandates a risk-based approach, which emphasizes recipient responsibility, capacity, Default Prevention and the management of defaults to ensure Programs are delivered and funds are expended in compliance with the terms and conditions of the funding agreement.

3.2 Expected Results

The expected results of this directive are to:

- support the success of individual funding agreements; ensure Programs are delivered in accordance with the terms and conditions of the funding agreement;

- ensure the Default Assessment confirms the existence of default and its causes;

- assist the recipient, where possible, in preventing defaults and reducing their severity, duration and recurrence;

- guide the departmental officials to allocate capacity development resources, when possible, to assist the recipient to address concerning areas and to support continuous improvement; and

- assist the departmental official(s) to identify areas of frequent and/or serious default across recipients and Programs in order to inform investments in finding common solutions of an operational and policy nature.

4.0 Context (Why does this directive matter?)

The department(s), through ongoing review of information available about the recipient's management of its funding agreement and through other strategies, will, to the extent possible, assist recipients in their efforts to prevent the occurrence of circumstances that may give rise to defaults.

While the responsibility of Default Prevention, identification and remediation lies with the recipient, the department(s), through the use of departmental tools, resources and processes, which are outlined in this directive and the Directive on Third Party Funding Agreement Management, will support the recipient's efforts in preventing and subsequently, identifying and addressing their default in an appropriate, timely and cost effective manner.The Default Prevention and Management Policy puts emphasis on maintaining relationships with the recipient, Default Prevention, capacity development and Sustainability.

This directive is developed to work in synergy with other elements of the department(s') Transfer Payments Policy Architecture and supports the objectives of the Treasury Board Secretariat Policy on Transfer Payments (2008) and the Directive on Transfer Payments (2008) utilizing a risk management approach outlining some of the primary business processes by which:

- defaults are identified;

- decisions are made by the department(s), based upon its assessment of the default situation, to identify the most appropriate Default Management action to employ, in order to implement prompt effective corrective strategies by the recipient;

- the department(s) will, to the extent possible, support recipients in their efforts to prevent defaults and address defaults;

- Default Management actions are monitored, adjusted and terminated based on demonstrated progress by the recipient in addressing their default;

- the department(s) will, to the extent possible, support multi-Program (ongoing) recipients in their capacity development to address concerning areas and avoid their recurrence; thereby minimizing the recurrence of defaults;

- the decision to appoint a Third Party Funding Agreement Manager is undertaken; and

- the decision to terminate a funding agreement is undertaken.

This directive should be read in conjunction with the "Default" and the "Remedies on Default" sections of the funding agreement.

The Directive on Financial Reporting and the Directive on Reporting Management provide for monitoring by the department(s) of recipient compliance to the financial and non-financial reporting requirements of funding agreements. These directives provide for remedies to be applied in the event of non-compliance.

This directive provides for additional action(s) to be taken in the event a recipient is in default of the terms and conditions of its funding agreement. In the highest risk situations, the directive on Third Party Funding Agreement Management will also be applicable.

A Default Assessment Workbook, a Default Assessment Tool, a Management Action Plan Workbook and a Guide on How to Select a Recipient-Appointed Advisor support the implementation of this directive.

The Chief Financial Officer has authority to issue this directive in support of the TBS Policy and Directive on Transfer Payments (2008), to amend or rescind this directive and to approve any exceptions to this directive that may be sought.

5.0 Directive Requirements and Responsibilities (How will the desired directive results be achieved and who does what under this directive?)

5.1 Responsibilities

Please refer to section 5.1 of the Default Prevention and Management Policy for a list of departmental officials and their responsibilities.

5.2 Default Prevention, Default Management and Sustainability Approach

5.2.1 Principles

This is a structured approach which emphasizes Default Prevention, recipient capacity development and Sustainability. When Default Management is required, the cooperation, willingness and capacity of the recipient as well as specific principles contained in the Default Prevention and Management Policy must be considered:

- recipients remain responsible and accountable for compliance with the terms and conditions set out in the funding agreement including effective management and use of resources involved, preventing defaults, and remediating and recovering from these defaults in a timely manner when they occur;

- the department(s) provides funding to recipients in accordance with the terms and conditions of funding agreements, reviews the recipient's accounting for the appropriate use of the funds provided, and applies this directive as appropriate;

- the department(s) strives to develop and maintain a co-operative relationship with recipients to enhance the capacity and financial health necessary for sustainable, efficient and accountable delivery of Programs ;

- the department(s), where possible, will strive to ensure incidents of defaults known to the department(s) are clearly communicated to the recipient;

- use of Management Development Plans will be strongly encouraged for preventing potential defaults;

- the department(s), where possible, will strive to make Default Management progressive, flexible and implemented in a manner which allows the recipient the opportunity to address the default; and

- the department(s), where appropriate, will allow Default Management to be implemented on a program specific basis so that the action taken is reasonable, cost effective and proportionate to Program risk.

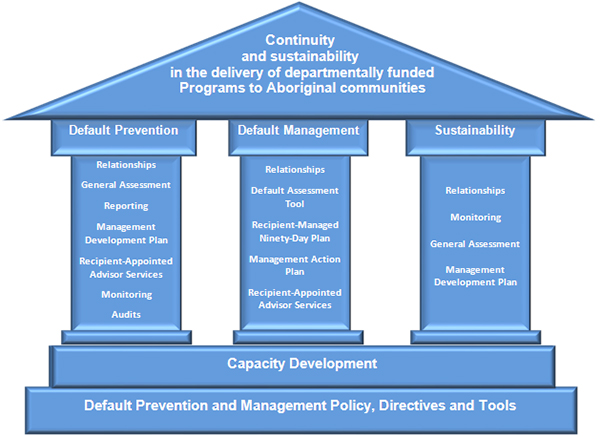

5.2.2 Three Pillar Approach of Default Prevention, Default Management and Sustainability

View text version of graphic

The following is a text description of the image that depicts the three part approach by which the Default Prevention and Management Policy will support the delivery of programs and services.

Described: a 3-column/pillar structure, representing each part of the 3-part approach of prevention, management, and sustainability set by the Default Prevention and Management Policy.

The structure comprises 4 parts:

- Triangle-shaped Roof;

- Three vertical rectangles representing pillars supporting the Roof;

- A rectangle representing the Floor; and

- A rectangle representing the Foundation.

The Foundation represents the base of the approach to facilitate the effective management of defaults. The tools and/or instruments are the policy, directives, and guidelines. The Foundation is labelled Default Prevention and Management Policy Directives and Guidelines.

The Floor is labelled Capacity Development.

The 3 Pillars are labelled as follows:

- Default Prevention, as the header, and sub-headers are labelled:

- Relationships

- General Assessment

- Reporting

- Management Development Plan

- Expert Resource Pools

- Monitoring

- Audits

- Default Management, as the header, and sub-headers are labelled:

- Relationships

- Default Assessment Tool

- Management Action Plan

- Management Development Plan

- Expert Resource Pools

- Sustainability, as the header, and sub-headers are labelled:

- Relationships

- Monitoring

- General Assessment

- Readiness Assessment

- Management Development Plan

The Roof represents the overall goal of Default Management and is labelled: Continuity and sustainability in the delivery of AANDC funded programs and services to Aboriginal communities.

5.2.3 Pillar 1 - Default Prevention

The department will perform, to the extent possible, ongoing reviews of available information on the recipient's management of the funding agreement, and through other strategies, assist recipients in their efforts to prevent the occurrence of circumstances that may give rise to defaults.

In the context of Default Prevention, attempts should be made to identify potential concerns in advance of a default happening. This is especially true where the default could become serious enough to affect the delivery of Programs to the community.

Historical information should be used to identify situations that could give rise to defaults and prevention opportunities as well as inform strategic investments in activities such as governance, financial and administrative capacity targeted at preventing defaults. Access to these strategic investment opportunities requires a plan by the recipient such as a plan developed under the Community Development Framework, a Management Development Plan or a similar plan which clearly identifies the potential benefits and need for the funding.

Maintaining a relationship with the recipient allows Funding Service Officers and Program Officers to identify areas of concern with respect to recipient capacity and being proactive in preventing situations that could give rise to defaults.

The Funding Service Officers and Program Officers should be alert to one or more of the following indicators which increase the potential for defaults. This list should not limit Funding Service Officers and Program Officers to consider other indicators:

- a medium or high rating in the General Assessment and/or a medium or high risk rating in a specific Program area;

- a poor or deteriorating financial position, including the erosion of a recipient's trust funds and Indian moneys capital and revenue accounts;

- increase in debt, such as operating lines that are not related to asset purchases and cannot be serviced from existing revenue streams;

- transfers of departmental funds into recipient controlled enterprises or other governmental Programs;

- election and governance disputes which result in the inability of a council to conduct business;

- lack of adherence to the accountability requirements in the funding agreement;

- enquiries and calls from unpaid employees, suppliers and other creditors;

- complaints from a First Nation members that the department's funded Programs are not being provided; and

- no business/operating plan and/or lack of adherence to plans.

On an ongoing basis, a Funding Service Officers and Program Officers perform a number of monitoring activities under the Management Control Framework, commensurate with the level of risk of the recipient. Through monitoring activities, causes for concern for a potential default or an actual default are documented and addressed. The monitoring activities below may uncover one or more indicators of potential default:

- working relationship – the Default Prevention and Management Policy emphasizes the relationship between the department and the recipient. This relationship involves ongoing and timely contact with the recipient to discuss and address concerns from either side;

- review of the General Assessment – use the General Assessment results to engage the recipient in risk mitigation strategies;

- financial audit – many defaults of a financial nature are identified through review of audited consolidated financial statements;

- auditors management letter - assesses whether the recipient has complied with the terms and conditions of the funding agreements and expresses an opinion on their financial statements;

- recipient audit – is an independent assessment that provides an assurance on a recipient's compliance with a funding agreement and may address any or all financial and non-financial aspects of the funding agreement.

- compliance review – Programs audit the recipient's compliance with the funding agreement to ensure that Programs are delivered in the manner in which they were intended;

- site visits – used to perform audit and compliance work on-site and to strengthen the ongoing working relationship between the department and the recipient. This allows the responsible official to observe the operational activities of the recipient and become aware of issues through interviews and discussions;

- complaints – through calls or e-mails from recipient membership, it may come to light that there are issues in the Program delivery that may not be obvious through information received from the recipient. Concerns arising from complaints and allegations may result in a recipient audit;

- reporting requirements – monitor the submission of timely reports; and

- cash management – confirming the use of funds and completion of the required activities under the funding agreement is a statutory requirement.

The presence of any of the indicators noted above is a warning sign that a default may happen or may be imminent. The responsible official monitors the default information through their own monitoring exercises in consultation with Program and compliance staff. At the Default Prevention stage, the responsible official is concerned with aiding the recipient in rectifying the situation that is causing the risk indicators to arise. Where there is a risk that the recipient is moving towards a default situation of its funding agreement, the following actions should be taken:

- the recipient should be informed by the department(s) of its concern(s) related to the funding agreement and that early attention to the issue could reduce the risk of a default or could reduce the impact of a default which could have a bearing on the recipient's future General Assessment scores;

- the recipient should then provide more detail on the department's concern(s) and to explore approaches on how it/they might be addressed;

- the targeted use of Recipient-Appointed Advisors may be recommended to help the recipient avoid moving into default of the funding agreement; and

- the recipient monitoring activities should be increased and the Transfer Payment Management Committee or regional equivalent should be advised of the potential default. The Committee should be notified and remain informed until the department(s) is satisfied with the situation.

If and when concerns arise relating to potential default(s), interactions with the recipient will take place via e-mail, telephone or letter. Where communication has taken place by phone, a log of the conversation must be documented detailing the date and time of the discussion, the recipient representative spoken to, and the outcome of the conversation. The communication with the recipient should outline the details of the departmental concern(s) and work with the recipient to explore approaches on how to address the concern(s). A ‘Concern(s) Relating to Funding Agreement' template letter has been developed to assist responsible departmental officials to communicate potential default(s) to the recipient.

If prevention activities are unsuccessful and a default occurs, the approach moves to pillar 2 - Default Management.

5.2.3.1 Default Identification

Information Sources

Defaults may be identified through the department(s') structured business processes (e.g., Default Assessment Tool or compliance regimes, etc...) or through less structured means (e.g., observations made during field visits). Grants and Contributions Information Management System provides protocols for capturing, storing and accessing both types of default information.

Informal Action

Funding Services Officers (or equivalent) monitor the default information provided by Program and compliance managers. When concerning trends are observed, they may contact the recipient to confirm the situation and encourage the recipient to rectify the default(s). Such (informal) action may be justified as appropriate, where two or more of the following are known to be true:

- the recipient has a low General Assessment risk rating;

- the specific defaults are low-risk in nature;

- the recipient is known to have initiated corrective action or has committed to doing so;

- an identifiable past event precipitated the default(s) (e.g. illness or loss of staff, surge in workload, etc.); and

- reasonable justification exists for late documents (e.g. sub-contractor information will not be received in time to submit report).

Formal Action not Initiated

Steps taken to contact the recipient to confirm the situation and a decision not to initiate formal action through a Default Assessment will be noted to file.

Initiating Formal Action

Where the Funding Services Officer (or equivalent) observes a concerning situation, steps will be taken to initiate a Default Assessment where:

- the nature of the default information suggests that the risk to the service population is high; or

- measures to encourage the recipient to rectify the defaults have not had the expected results.

Information on the Default Assessment process can be found in section 5.2.4.1. Default Assessment.

5.2.4 Pillar 2 – Default Management

Default Management is a process for identifying and managing defaults of a funding agreement. There are a wide range of actions available to the department(s). The action(s) chosen must be necessary, progressive, and reasonable in the circumstances and must be communicated to the recipient without limiting any remedy or other action Canada may take under the funding agreement. The actions taken must be well documented and need to be based on documented facts and not conjecture.

The legal underpinnings of Default Management activities are contained within the text of the funding agreement signed by the recipient. The range of actions the department(s) may take on default are listed there.

A default is specified in the funding agreement and may include:

- the recipient defaults on any of its obligations set out in the current funding agreement, a prior agreement, or in any other agreement through which a federal department funds the recipient;

- the auditor of the recipient gives a disclaimer of opinion or adverse opinion on the audited consolidated financial statements of the recipient;

- in the opinion of the department(s), having reviewed financial information relating to the recipient, the delivery of programs funded under the agreement are at risk of being compromised;

- in the opinion of the department(s), the health, safety or welfare of the Aboriginal community is at risk of being compromised, or;

- in the case of an incorporated recipient, the recipient becomes bankrupt or insolvent, goes into receivership, takes the benefit of any statute from time to time being in force relating to bankrupt or insolvent debtors, or ceases to be in good standing with whichever federal or provincial jurisdiction in which the recipient was incorporated.

5.2.4.1. Default Assessment (DA)

The Default Assessment is a structured business process used to confirm the existence of default, identify its causes and recommend a principle default action that is assessed as a reasonable way to proceed.

The Default Assessment Tool is the tool used by the Funding Service Officer or responsible official to complete a Default Assessment. He/she may update the recipient's General Assessment, as a first step in initiating a Default Assessment, for the purpose of presenting to approval authorities, the current status and range of potential issues that may impact delivery of departmentally-funded Programs. The completion of the Default Assessment Tool will then help assess if an actual default has occurred or not. If a default does exist, the Default Assessment Tool will help identify the level of risk of the default and aid the department(s) in deciding the appropriate Default Management action.

The responsible official will determine, for a recipient in a default situation:

- the risk to the service population which examines the impact of the Program(s) in question and the impact on the service population if not delivered and how well the recipient and service population could or will recover from the potential or actual default;

- the risk to remediation which is an interaction between the performance/capacity or ability of the recipient to correct a default, and the willingness of the recipient to remedy the default in a timely manner;

- the overall Default Assessment risk rating; and

- any recommended Default Management action(s) - informed by the overall Default Assessment risk rating process.

The Default Assessment is completed in accordance with the Default Assessment Workbook and instructions issued by the Chief Financial Officer. The completed Default Assessment Tool should then be saved into the Grants and Contributions Information Management System.

The overall Default Assessment risk rating classifies recipients as having a "low", "medium" or "high" risk profile. Based on the recipient's risk rating, the appropriate delegated authority, as outlined in the table below, is provided with the Default Assessment and the recommended Default Management action(s) for review. Such actions may or may not be accepted by the delegated authority, who may choose to provide alternatives that are less intrusive to the recipient.

| Overall Risk Level | Multi-Program (Ongoing) Recipient | Project and Specific Service Recipients | Approval |

|---|---|---|---|

| Low Risk | Recipient-Managed (i.e.: Ninety-Day Plan for corrective strategies) | Recipient-Managed (i.e.: Ninety-Day Plan for corrective strategies) | Funding Services Manager or equivalent with notification to Regional Transfer Payment Management Committee (TPMC) or equivalent |

| Medium Risk | Management Action Plan (MAP) or MAP with Recipient-Appointed Advisory services | Management Action Plan (MAP) or MAP with Recipient-Appointed Advisory services | Regional TPMC or equivalent |

| High Risk (As a Last Resort) | Third Party Funding Agreement Management | Terminate Agreement | Program / Regional Director General/Regional Executive Officers |

5.2.4.1.1 Risk to Service Population

Risk to service population as outlined in the Default Assessment Workbook is determined in consideration of the actual or potential consequences of a default situation; and the degree of urgency associated with correcting the defaults.

Information about the recipient is compared to the risk to service population "considerations" or sources of risk as outlined in the Default Assessment Workbook, to determine a risk score for each default. The risk scores are used to prioritize corrective action. The "cumulative score for all defaults" is used to classify the overall risk to service population risk rating as being low, medium or high.

5.2.4.1.2 Risk to Remediation

Information about the recipient is compared to the risk to remediation "considerations" as outlined in the Default Assessment Workbook to determine a low, medium or high risk to remediation rating.

5.2.4.1.3 Overall Default Assessment Risk Rating

The overall Default Assessment risk rating is based upon the risk to service population and risk to remediation crosswalk table provided in Exhibit 5 / Table 1 presented in the Default Assessment Workbook.

A Default Management action is determined in proportion to the overall Default Assessment risk rating. This rating may be supplemented by the judgement of the responsible officer, who will draw upon information which may be available.

Thereafter, the responsible officer will recommend a Default Management action. If the recommendation differs from that generated by the Default Assessment, a rationale will be provided.

5.2.4.2 Principal Default Management Actions

Subject to the terms and conditions of the funding agreement, the department(s) may employ the following steps in order of escalation:

- for minor defaults, require the recipient to develop and implement a Recipient-Managed Ninety-Day plan within thirty (30) calendar days from the day the default notice is given;

- require the recipient to develop and implement a Recipient-Managed Management Action Plan within sixty (60) calendar days from the day the default notice is given;

- in higher risk cases of recipient default, the department(s) may require the recipient to engage a Recipient-Appointed Advisor that is acceptable to the department(s);

- withhold any funds otherwise payable under a funding agreement;

- require the recipient to take any other reasonable action necessary to remedy the default;

- take such other reasonable action(s) as the department(s) deems necessary;

- in the highest risk cases of default, the department(s) may appoint, upon providing notice to the recipient, a Third Party Funding Agreement Manager; or

- ultimately, the department(s) may terminate the funding agreement.

When deciding on default measures, the department(s) must consider the following:

- the effective communication with recipients about their default and planned actions. A ‘Notice of Default Action' template letter has been developed to assist responsible officials in communicating default-related information to recipients;

- the risks and circumstances associated with the default;

- the degree of co-operation between the recipient and the department(s);

- the willingness and ability of the recipient to address the default;

- the actions to be taken will be only as intrusive as is necessary to address the default;

- the Third Party Funding Agreement Manager appointment is used as a last resort under the Default Prevention and Management Policy, and is only used to ensure the continued delivery of Programs to community members; and

- the recipient must receive notice and have the opportunity to address the default before increasing the level of Default Management. However, there may be circumstances where the department will need to act quickly without first giving the recipient an opportunity to address the default.

The department(s) or recipient can, at any time, identify reasonable actions that they may take to address a default. This can include withholding of all or part of the funds normally payable under the funding agreement, until the default is corrected. Defaults in reporting may result in the halt of funds and will be subject to the Directives on Financial Reporting and Reporting Management, and the Management Control Framework that is programmed within the Grants and Contributions Information Management System.

Default Management actions are applied based upon the overall Default Assessment risk rating determined through the Default Assessment process and accepted by the departmental official with delegated authority (see Exhibit 1). The principal Default Management action may be amended upon the approval of the delegated authority in consideration of progress being made by the recipient in remedying their default(s); and as supported by an update of the Default Assessment.

| Principal Default Management Action | Recommended by | Accepted by |

|---|---|---|

| Initiate Recipient-Managed (i.e.: Ninety-Day Plan) | Funding Service Officer or equivalent | FSO Manager with notification to Regional Transfer Payment Management Committee (TPMC) or equivalent |

| Withhold Funds | FSO or equivalent | FSO Manager or equivalent |

| Require Management Action Plan (MAP) | FSO Manager or equivalent | TPMC or equivalent |

| Appoint Third Party Funding Agreement Manager | TPMC or equivalent | Program / Regional Director General/Regional Executive Officers |

| Terminate Agreement | TPMC or equivalent | Program / Regional Director General/ Regional Executive Officers |

There are four potential outcomes of the Default Management action evaluation process:

- remediation is not progressing as anticipated – reassessment required. The plan may be adjusted in response to changing circumstances or to improve performance;

- remediation is progressing as anticipated – plan may be adjusted in response to changing circumstances or to improve performance;

- remediation complete – exit strategy is applied; or

- remediation is no longer required.

5.2.4.2.1 Default Management Action 1: Recipient-Managed Ninety-Day Plan

Where the overall Default Assessment risk rating is low and the recipient is deemed capable of remedying the default(s) within approximately 90 days, with appropriate approval, the responsible official will communicate to the recipient:

- the option to prepare a corrective strategy to remedy the default(s) within thirty (30) calendar days from the day the default notice is given;

- support that may be available to the recipient to assist in remedying their default(s); and

- the department's decision on whether to accept the corrective strategy formulated by the recipient.

Recipient-Appointed Advisors can be implemented for single or multiple Programs or be applied to all departmentally funded Programs and core administration. A Recipient-Appointed Advisor is used when the recipient is willing but lacks the capacity to address a default. As funding for Recipient-Appointed Advisors is not provided by the department, a Management Action Plan should be considered prior to requiring Recipient-Appointed Advisor support.

Within the corrective strategy, the recipient will be required to set out the action to be taken and by whom within the 90 day timeframe. The responsible official will approach the recipient to formulate mutually agreed upon benchmarks and will subsequently monitor progress against such benchmarks. The corrective strategy is not incorporated in the funding agreement as an amendment.

5.2.4.2.2 Default Management Action 2: Withholding of Funds

Once a default has been identified, the responsible official may withhold funds. Such funds would have otherwise been payable under a funding agreement.

The Directives on Financial Reporting and Reporting Management authorize the withholding of funds without the undertaking of a formal Default Assessment process.

5.2.4.2.3 Default Management Action 3: Requirement to Prepare a Management Action Plan

Where the overall Default Assessment risk rating is medium and upon acceptance by the Transfer Payment Management Committee or equivalent, the department(s) will notify the recipient in writing of the requirement to prepare a Management Action Plan.

The department(s) will ask the recipient to amend the funding agreement and include the Management Action Plan and assign a Data Collection Instruments (DCI) for quarterly reporting requirements.

A Recipient-Managed Management Action Plan is used when the recipient is willing and has the capacity to remedy the default. This is a recipient led activity that must be acceptable to the department(s).

The following principles apply in defining Management Action Plan requirements:

- development and implementation of the Management Action Plan must reflect the risk to the service population and is to be completed within 60 calendar days from the day the default notice is given;

- individual defaults or like groups of defaults are prioritized by risk level;

- to the extent possible, the Management Action Plan supports ongoing recipients in sustaining the level of contribution authority that they exercise and innovations made to improve Program outcomes;

- the Management Action Plan is scaled to the complexity of the default situation. This may include preparation of a Management Action Plan - Financial Plan where the recipient must improve its financial position; and a Management Action Plan - Capacity Development Plan where the recipient must improve staff qualifications or skills to remedy the default;

- the responsible official may require that any of a series of measures be integrated into the Management Action Plan to support success in a particular situation (e.g. use of a Recipient-Appointed Advisor, Tribal Council, etc.);

- a list of Management Action Plan review and acceptance criteria can be found in the Management Action Plan Workbook;

- when the recipient lacks the capacity to develop or implement a Management Action Plan, the targeted use of a Recipient-Appointed Advisor will also be a requirement for Management Action Plan approval;

- the Management Action Plan may be amended by the parties in view of changing circumstances or with a view of improving outcomes;

- the requirement for a Management Action Plan may be removed where the high and medium risk defaults, identified through notice to the recipient, have been addressed by the recipient;

- the Management Action Plan - Capacity Development Plan may continue to be implemented by the recipient, after termination of the Management Action Plan, to provide for longer-term stability / resilience of the recipient and with the aim to avoid recurrence of the defaults; and

- a list of review criteria for exit from Management Action Plan also exists and can be found in the Management Action Plan Workbook.

5.2.4.2.4 Default Management Action 4: Third Party Funding Agreement Management

This is the most costly and intrusive Default Management action and should be used as a last resort to ensure the continued delivery of Programs to community members. The responsible official will, upon approval of the Region / Program Head, notify the recipient of the appointment of a Third Party Funding Agreement Manager. Third Party Funding Agreement Manager may be determined to be the most appropriate Default Management action in the following circumstances:

- the Overall Default Assessment Risk Rating is high;

- governance dispute and the department cannot identify a First Nations leadership or loss of quorum prevents business from being conducted;

- the recipient is unwilling and/or unable to rectify its default situation;

- the implementation of the Management Action Plan, within the required timeframe or the use of Recipient-Appointed Advisory services proves to be unsuccessful;

- extraordinary circumstances dictate the need for a Third Party Funding Agreement Manager.

See the Directive on Third Party Funding Agreement Management for more information on this Default Management action.

To assist the responsible official, a supplementary consideration tab has been added to the end of the Default Assessment Tool in order to further assess whether or not appointing a Third Party Funding Agreement Manager is the most appropriate course of action. This consideration tab involves a number of questions, which are generally answered yes or no, and a space is provided to document evidence to support the assessor's responses. The questions are meant to aid in the decision-making process and to provide the final decision maker with all the information that is at the department(s') disposal.

5.2.4.2.5 Default Management Action 5: Termination of Agreement

Where the overall Default Assessment risk rating is high and upon approval of the Region / Program Head, the responsible official will notify the recipient, in writing, that the agreement will be terminated and provide the reasons for its termination.

The responsible official may give the recipient up to 14 calendar days from the time the recipient receives the Notice issued by the department(s) to provide information which would indicate that a default has not occurred or has already been addressed.

Upon termination, the department(s) will:

- pay any amounts owing to the recipient;

- cease scheduled payments;

- require an accounting record from the recipient for all expenditures under the agreement or arrange for an independent audit of such expenditures;

- require reimbursement of unexpended funding and ineligible expenditures; and

- take other actions as the responsible official deems necessary under the circumstances to minimize impacts on the service population and protect the public's interest.

5.2.5 Pillar 3 – Sustainability

Sustainability emphasizes the proactive and strategic measures taken to ensure continuous Program delivery and help identify capacity gaps that may lead to a default in the terms and conditions of the funding agreement if not addressed. The Default Prevention and Management Policy is meant to accentuate the building and maintenance of relationships with the recipient so that funding agreements are in compliance, and continue to be in compliance. The department(s) will work with the recipient to monitor progress on any action plans that have been created to build recipient capacity and assist the recipient to address and rectify a default situation. A view to building recipient capacity should be taken through all processes related to Default Prevention and Management. Where this is the case, recipients often emerge from successful Default Prevention and Default Management with increased capacity and higher chances of avoiding default in the future.

Below are ways the department can assist the recipient in capacity building:

General Assessment (GA)

The preparation of the General Assessment may identify capacity issues. These are addressed through mitigation strategies and are monitored on an ongoing basis. The resolution of these issues also builds capacity. Tackling these capacity development gaps ensures the recipient's continued delivery of Programs to its members.

Management Development Plan (MDP)

The department(s) encourages recipients to engage in a process of continuous improvement and make a Management Development Plan a part of the continuous improvement process. A Management Development Plan may contain some elements that formed part of an exit strategy from Default Management or utilize the General Assessment Workbook for determining recipient eligibility for block contribution funding or other flexible funding approaches to complete a gap analysis. Plans such as a Management Development Plan and similar plans are encouraged as they may enable recipient eligibility for capacity development funding.

Recipient-Appointed Advisor (RAA)

The targeted hiring of a Recipient-Appointed Advisor is a measure taken by the recipient to address gaps in the recipient's capacity before a default occurs. A guide has been prepared for recipients of departmental funding who need and/or are required to seek advisory support in addressing individual Program areas.

Community Development Framework

The Framework describes an approach to community development in Aboriginal communities that is intended to facilitate the improvement of individual and collective outcomes, well-being and quality of life in Aboriginal communities. The approach is investment based and responds to the needs of community developed and owned plans while providing access to a broad array of capacity programming from as many departments as possible. The department will work closely with recipients and other partners where feasible to support this principle. The objective is to identify and appropriately apply available resources to help maintain or establish sustainable Program delivery and prevent defaults.

Professional and Institutional Development Program (P&ID)

The objective of this program is to develop the capacity of First Nations and Inuit communities in order to perform core functions of government, by funding governance-related projects at the community and institutional levels. Each region of the department has an independent budget for the Professional and Institutional Development Program, for use in funding projects that will benefit the governance capacity of First Nations and Inuit communities in that region. To access this funding, First Nations are encouraged to complete the Governance Capacity Planning Tool, which is a practical, step-by-step, independent workbook that allows First Nations to develop a five-year roadmap to plan and prioritize governance capacity-building projects and initiatives that are more community-focussed.

Aboriginal Organizations

Recipients may also refer to Aboriginal Organizations that support First Nations in developing their financial, administrative and management capacity. Two such organizations are:

Tribal Councils

Tribal Councils are funded by the department under the Tribal Council Funding Program Policy. They are mandated to provide specific advisory services and are responsible for helping their member First Nations develop capacity.

Communities of Practice

Recipients can build capacity by looking to other communities of practice (e.g. other First Nations/Tribal Councils) who are willing to share their best practices.

6.0 Oversight and Internal Controls

Additional oversight and controls support due diligence and are in place to ensure enforcement of this directive through the following activities:

- the Grants and Contributions Information Management System regiments the tracking of all recipient obligations and makes relevant information accessible for default identification and trend analysis;

- the risk assessment tools, such as the General Assessment and the Default Assessment, contain benchmarks to which information about a recipient is compared in order to arrive at a risk profile;

- the review of decision documents by senior personnel, in conformance with a risk-based delegation of authority, to assess recommendations and support a consistent approach across recipients; and

- the Default Management actions implemented through notice, as required by the funding agreement; and stating the cause for action.

6.1 Staff Support

The department(s) will, to the extent possible, support the development of staff skills in order to meet organizational requirements including:

- staff training with respect to the transfer payment management control framework and its supporting business processes; and

- national and regional Centres of Expertise to support staff in the exercise of their responsibilities.

6.2 Oversight of the Default Management Process

Oversight of the operation of the Management Control Framework and transaction processing is managed by the Chief Financial Officer and Audit and Evaluation Services.

6.3 Review / Evaluation of the Default Management Process

The Grants and Contributions Information Management System provides performance indicators for review/evaluation of this directive including:

- the General Assessment module which provides a multi-year database providing a risk profile at the entity and Program level for recipients at various levels of Default Management; and

- the Default Management module which provides a multi-year data base of recipient histories.

6.4 Relations with Recipient

Engagement of the recipient in default situations including:

- responding to requests by the recipients clarifying the department(s') view on the requirements of the funding agreement;

- providing timely information to the recipients on the default(s) of which the department(s) is/are aware of; and

- supporting capacity development to adjust the recipient's capacity to the requirements; prior to entering into the funding agreement through the General Assessment process, or over the life of the funding agreement through the Default Assessment process.

7.0 Consequences (What happens when significant issues arise under this directive?)

The consequences of non-compliance with this Directive are set out in section 7 of the Default Prevention and Management Policy (2013).

8.0 Enquiries

For enquiries and interpretations, please contact (as applicable):

9.0 Appendices

Appendix A - References

Treasury Board Secretariat: Policy on Transfer Payments (2008)

Treasury Board Secretariat: Directive on Transfer Payments (2008)

AANDC: Management Control Framework for Grants and Contributions

AANDC: Default Prevention and Management Policy (2013)

AANDC: Directive on Third Party Funding Agreement Management

AANDC: Directive on General Assessment

AANDC: Directive on Financial Reporting

AANDC: Directive on Reporting Management