Archived: Directive 205 - Default Prevention and Management

Download PDF Version (333 Kb, 35 Pages)

Table of Contents

- 1.0 Effective Date

- 2.0 Application (Who Does this Directive Apply to?)

- 3.0 Directive Statement (What is the Directive Designed to Achieve?)

- 4.0 Context (Why this Directive Matters?)

- 5.0 Directive Requirements and Responsibilities (How will the Desired Directive Results be Achieved and who Does what Under this Directive?)

- 6.0 Emergency Situations

- 7.0 Oversight and Internal Controls

- 8.0 Consequences (What Happens when Significant Issues Arise Under this Directive?)

- 9.0 Enquiries

- Appendix A — References

- Appendix B — Definitions

1.0 Effective Date

This Directive takes effect on June 2011.

1.1 Transitional Considerations

Considerations during the transition from the Funding Arrangements: Intervention Policy, effective April 1, 2007 to the Default Prevention and Management Policy, effective June 2011, includes the following:

- existing default management actions, expected to achieve the required results by March 31, 2012 may continue. All outstanding requirements on March 31, 2012 will come under this directive thereafter;

- existing default management actions (e.g. Recipient-managed in accordance with Remedial Management Plans and Co-Managed interventions), not currently achieving the required results or not expected to do so by March 31, 2012, will be brought under this directive as soon as practicable. A Default Assessment (DA) will be used to do so and transition must be completed within a year following initial discussions with the Recipient;

- new default management actions will be developed and implemented under this directive;

- in higher risk situations, the directive on Third Party Funding Agreement Management (2011) may come into play.

2.0 Application (Who Does this Directive Apply to?)

This directive applies to Aboriginal Affairs and Northern Development Canada (hereinafter referred to as the Department) officials managing transfer payments. This directive does not apply to funding provided under legislated self-government agreements and Funding Agreements resulting from federal-provincial accords.

3.0 Directive Statement

(What is the Directive Designed to Achieve?)

3.1 Objective

This objective of this directive is to aid in the implementation of the Default Prevention and Management Policy (DPMP) through departmental processes which identify defaults. The DPMP mandates a risk based approach, which emphasizes Recipient responsibility and capacity, default prevention and the management of defaults to ensure Programs, projects and services are delivered and funds expended are in compliance with Treasury Board Authorities and the Financial Administration Act. The objective of the Policy on the Default Prevention and Management is:

- support community capacity development so that communities continue to increase their ability to self-manage and prevent default and default recurrence;

- assist Recipients, where possible, in preventing defaults of Funding Agreements;

- assist Recipients, where possible, in their timely management and remediation of defaults;

- maintain continuity in the delivery of departmentally funded Programs and services to Aboriginal communities while the Recipient is in default; and

- meet the requirements for departmental accountability, transparency, and effective internal control in the management of departmental transfer payment Programs.

3.2 Expected Results

The expected results of this directive are to:

- support the success of individual Funding Agreements; ensure Programs, projects and services are delivered in accordance with the terms and conditions of the Funding Agreement, Treasury Board authorities and the expected Program outcomes;

- assist the Recipient, where possible, in preventing, reducing the severity, duration and recurrence of defaults;

- allocate capacity development resources, when possible, to assist the Recipient to rectify difficulties and support continuous improvement; and,

- identify areas of frequent and/or serious default across Recipients and Programs in order to inform investments in finding common solutions — of an operational and policy nature.

4.0 Context

(Why this Directive Matters?)

The Department, through ongoing review of information available about the Recipient's management of funding and through other strategies, will, to the extent possible, assist Recipients in their efforts to prevent the occurrence of circumstances that may give rise to defaults.

While the responsibility of default prevention, identification and remediation lies with the Recipient, the Department, through the use of departmental tools and resources and the processes which are outlined in this directive and the Third Party Funding Agreement Management Directive, will support the Recipient's efforts in initially preventing and subsequently, identifying and remediating their default in an appropriate, timely and cost effective manner.

There is greater emphasis in the Default Prevention and Management Policy on maintaining relationships with the Recipient, prevention, capacity development and sustainability. The following are important changes which provide for a more flexible and positive context:

| Funding Arrangements: Intervention Policy | Default Prevention and Management Policy (DPMP) |

|---|---|

| Recipient-managed in accordance with Remedial Management Plans (RMP) | Management Action Plans (MAP) |

| Co-management | Expert Resource Support |

| Third Party Management | Third Party Funding Agreement Manager (AANDC funded Program only) |

| Intervention imposed on the Recipient as whole entity | Default prevention and management may be targeted at a specific Program |

This directive is developed to work in synergy with other elements of AANDC Transfer Payments Policy Architecture and supports the objectives of the Treasury Board Secretariat (TBS) Policy on Transfer Payments (2008) and directive on Transfer Payments (2008) utilizing a risk management approach outlining some of the primary business processes by which:

- defaults are identified;

- decisions are made by the Department, based upon its assessment of the default situation, to identify the most appropriate default prevention and management action to employ, in order to prompt effective corrective strategies by the Recipient;

- the Department will, to the extent possible, support Recipients in their efforts to remedy their defaults;

- default management actions are monitored, adjusted and terminated based on demonstrated progress by the Recipient in remedying their default;

- the Department will, to the extent possible, support multi-Program (ongoing) Recipients in their capacity development to rectify difficulties and avoid their recurrence; thereby minimizing the recurrence of defaults;

- the decision to appoint a Third Party Funding Agreement Manager is undertaken; and

- the decision to terminate a Funding Agreement is undertaken.

This directive should be read in conjunction with the "default" and the "remedies on default" sections of the Funding Agreement.

The Directives on Financial Reporting (2011) and Reporting Management (2011) provide for monitoring by the Department of Recipient compliance to the financial and non-financial reporting requirements of the Funding Agreements. These directives provide for remedies to be applied in the event of non-compliance.

This directive provides for additional action(s) to be taken in the event a Recipient is in default of its Funding Agreement. In higher risk situations, the directive on Third Party Funding Agreement Management (2011) may also be applicable.

A Default Management User Guide (2011) and a Management Action Plan Workbook (2011) support implementation of this directive.

The Chief Financial Officer (CFO) has authority to issue this directive in support of the TBS Policy and Directive on Transfer Payments (2008), to amend or rescind this directive and to approve any exceptions to this directive that may be sought.

5.0 Directive Requirements and Responsibilities

(How Will the Desired Directive Results be Achieved and Who Does What Under this Directive?)

5.1 Responsibilities

In addition to the responsibilities assigned to responsible officials within the Default Prevention and Management Policy, the following duties are to be fulfilled by:

As a Chief Accounting Officer, Deputy Minister is responsible for:

- ensuring that the Department has the capacity to implement and oversee this directive; and

- ensuring that controls are in place to manage Recipient defaults in a manner that is cost effective and proportionate to Program and Recipient risks.

The Chief Financial Officer (CFO), who through the Transfer Payment Centre of Expertise (TPCOE), is responsible to:

- maintain this directive;

- provide oversight on the implementation of this directive including investigating and acting when significant issues arise regarding directive compliance and monitoring to certify that appropriate remedial actions are taken to address these issues;

- provide interpretation, advice and support for the implementation of this directive including the development of guides, working tools, training; definition of the user requirements for development of First Nations and Inuit Transfer Payment (FNITP) and finally bring to the Deputy Minister's attention, any significant difficulties or gaps in performance; and

- ensure a challenge function is established by Regional Directors Corporate Services or their equivalent and tools for exercising this function;

- establishing a Program for functional review of the implementation of this directive.

The Regional Operations Senior Assistant Deputy Minister is responsible for:

- ensuring the strategies for capacity development, prevention of defaults, and sustainability in the delivery of Programs and services are implemented to meet the requirements of this directive.

Assistant Deputy Ministers are accountable to the Deputy Minister for:

- ensuring that appropriate capacity is in place to implement the requirements of this directive.

Regional and Headquarter (HQ) Director Generals with Program funding responsibilities are accountable to their Assistant Deputy Ministers for:

- review the incidence of defaults within their Program areas to determine if Program design, supporting operating systems or support to staff and Recipients requires adjustment to reduce the incidence of default;

- ensuring appropriate oversight of default management decisions in their regions/directorates;

- monitoring compliance with this directive and its supporting guidelines through periodic audits and other assessments to ensure their effective implementation. Regions are to take corrective action when needed;

- ensuring staff compliance with this directive;

- bring into place region/sector procedures to implement this directive in the context of the region/sector organization and provide for its periodic review;

- bring into place a governance structure for the approval of decision documents which may include a Transfer Payment Management Committee (TPMC), including an independent challenge function by the CFO;

- developing and implementing quality assurance reviews to determine if planned and actual regional processes conform to the requirements of this directive and are being carried out;

- implementing the national outreach and communications strategy to build understanding of the policy and its operational requirements; and to engage staff and Recipients in default management; and

- ensuring effective management of Recipient defaults for agreements that they administer;

- approving default management strategies for Recipients with high overall default management risk levels.

The Regional Operations Sector & Northern Affairs Organization, in supporting the consistent and cost-effective implementation of this Directive across regions are responsible to:

- monitor the attainment of service standards;

- identify cross-regional issues with respect to implementation of this directive and develop and implement common solutions or recommend them to the responsible sector;

- review the nature and frequency of defaults to define priority areas requiring national development activities and working with other sectors as required to address these;

- integrate the implementation of this directive with those directives supporting risk management and capacity development.

Regional Directors, Corporate Services in their arms-length oversight role with respect to regional operations are responsible to:

- provide advice, support, and assistance in developing region/sector procedures which provide for due diligence and allow it to be demonstrated;

- implement functional review activities in accordance with the requirement of the TPCOE.

Regional Funding Services Officers (FSOs) or their equivalents who are the primary point of contact between AANDC and the Recipients assigned to them, are responsible to:

- lead completion of the General Assessment and engage the Recipient in risk mitigation activities to bring the funding relationship within AANDC's risk tolerance;

- draw upon all relevant Program areas in managing the funding relationship;

- oversee the department's obligations in the Funding Agreement. The FSOs are responsible to make the Recipient aware of any departmental concerns regarding compliance with the Funding Agreement. They are also to notify the Recipient of the need to take corrective action where the Department assesses it to be required, based upon the information available to the Department;

- remain informed of extraordinary events impacting or with the potential to impact agreement performance;

- record defaults in FNITP that they become aware of in their role, and that are not otherwise recorded by ongoing report management;

- initiate a default assessment where required (outlined in 5.2.3.1) and recommend appropriate default management action(s);

- coordinate implementation of default management action(s) in accordance with this directive which may include informing the Recipient of and assisting it to access expert resources that the Recipient may wish to access to assist it in remedying their defaults and avoiding their recurrence;

- maintain related documentation in accordance with departmental standards and systems.

5.2 Default Prevention, Management and Sustainability Approach

5.2.1 Principles

This is a structured approach which emphasizes prevention, Recipient capacity development and sustainability. When default management is required, the cooperation and capacity of the Recipient as well as specific principles contained in the Default Prevention and Management Policy must be considered:

- Recipients remain responsible and accountable for compliance with the terms and conditions set out in Funding Agreement including effective management and use of resources involved, preventing defaults, and remediating and recovering from these defaults in a timely manner when they occur;

- AANDC provides funding to Recipients in accordance with Funding Agreements, reviews the Recipient's accounting for the appropriate use of the funds provided, and applies this policy and related directives as appropriate;

- AANDC strives to develop and maintain a co-operative relationship with Recipients to enhance the capacity and financial health necessary for sustainable, efficient and accountable delivery of Programs and services;

- AANDC, where possible, will strive to ensure incidents of defaults that AANDC becomes aware of are clearly communicated;

- use of voluntary management development plans will be strongly encouraged for addressing low risk defaults;

- AANDC, where possible, will strive to make default management progressive, flexible and implemented in a manner which allows the Recipient the opportunity to remedy the default; and

- AANDC, where appropriate, will allow default management to be, on a Program specific basis to insure the action taken is reasonable, cost effective and proportionate to Program risk.

5.2.2 Three Pillars of Default Prevention, Management Sustainability Approach

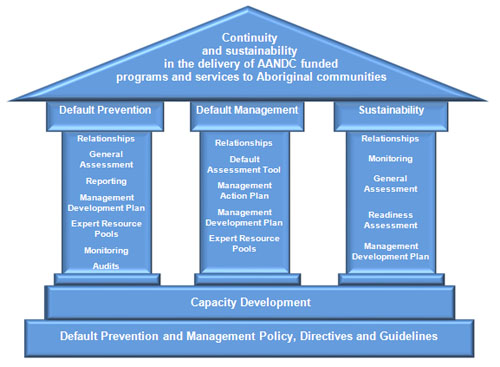

Text description of this graph

The following is a text description of the image that depicts the three part approach by which the Default Prevention and Management Policy will support the delivery of programs and services.

Described: a 3-column/pillar structure, representing each part of the 3-part approach of prevention, management, and sustainability set by the Default Prevention and Management Policy.

The structure comprises 4 parts:

- Triangle-shaped Roof;

- Three vertical rectangles representing pillars supporting the Roof;

- A rectangle representing the Floor; and

- A rectangle representing the Foundation.

The Foundation represents the base of the approach to facilitate the effective management of defaults. The tools and/or instruments are the policy, directives, and guidelines. The Foundation is labelled Default Prevention and Management Policy Directives and Guidelines.

The Floor is labelled Capacity Development.

The 3 Pillars are labelled as follows:

- Default Prevention, as the header, and sub-headers are labelled:

- Relationships

- General Assessment

- Reporting

- Management Development Plan

- Expert Resource Pools

- Monitoring

- Audits

- Default Management, as the header, and sub-headers are labelled:

- Relationships

- Default Assessment Tool

- Management Action Plan

- Management Development Plan

- Expert Resource Pools

- Sustainability, as the header, and sub-headers are labelled:

- Relationships

- Monitoring

- General Assessment

- Readiness Assessment

- Management Development Plan

The Roof represents the overall goal of Default Management and is labelled: Continuity and sustainability in the delivery of AANDC funded programs and services to Aboriginal communities.

Figure 1 — Templates of these working tools are available in electronic format from the Transfer Payments Directorate — Centre of Expertise.

The three pillars of the Default Prevention, Management and Sustainability Approach as displayed above are:

- Default Prevention;

- Default Management;

- Sustainability.

The operational requirements for each of these pillars will be the focus of the remainder of this directive. The Default Management User Guide and Management Action Plan Workbook will provide detailed guidelines and/or examples of:

- default assessments;

- Management Action Plans;

- content of a notice; and

- principal default management actions and evaluation process.

5.2.3 Pillar 1 — Default Prevention

Default prevention is an ongoing process that focuses on relationships with funding Recipients and is inherent in existing AANDC business processes. As noted in figure 1, this includes reporting; inclusive of review and follow-up,Footnote 1 the yearly audit review of Recipient audited financial statements and the General Assessment. In addition there should be ongoing monitoring including site visits by Funding Services Officers (FSO) and Program Officers (PO), Program compliance audits and investigation of complaints and allegations.

Information available from the past and these sources should be used to identify potential defaults and prevention opportunities as well as inform strategic investments in activities such as governance, financial and administrative capacity targeted at preventing defaults. Access to this funding requires a plan by the Recipient such as a plan developed under the Community Development Framework, a Management Development Plan or a similar plan which clearly identifies the potential benefits and need for the funding.

Maintaining a relationship with the Recipient allows FSOs and POs to identify areas of concern with respect to Recipient capacity and being proactive in preventing defaults. The FSOs and POs should be alert to one or more of the following indicators which increase the potential for defaults. This list should not limit FSOs and POs to consider other indicators:

- a medium or high rating in the General Assessment and/or a medium or high risk rating in a specific Program area;

- late and incomplete reporting leading to system halts (FNITP) of Program funding. This includes late filing of the audited financial statements, major qualifications or a disclaimer of opinion on the audit;

- a poor or deteriorating financial position as identified by key indicators in the Directive on Financial Assessment. This includes the erosion of a Recipient's trust funds and Indian moneys capital and revenue accounts;

- increase in debt, such as operating lines that are not related to asset purchases and cannot be serviced from existing revenue streams;

- transfers of departmental funds into Recipient controlled enterprises or other governmental Programs;

- election and governance disputes which result in the inability of a council to conduct business;

- lack of adherence to the accountability requirements in the Funding Agreement;

- enquiries and calls from unpaid employees, suppliers and other creditors;

- complaints and allegation from a Nation's Members of AANDC funded services not being provided, and,

- no business/operating plan or budgets and/or lack of adherence to budgets.

Prevention relies on the willingness of the Recipient to work with departmental officials to address financial, administrative and capacity issues. When conditions exist that indicate the potential for default, there should be engagement with the Recipient to discuss departmental concerns. This may be informal through phone calls and meetings or more formal though observations made in the yearly audit review letter or written notifications of Program compliance audit results. The following activities should be undertaken when there is a risk that the Recipient would be moving into default of its Funding Agreement:

- the Recipient should be asked to remedy the situation and be provided with reasonable timelines to action the request;

- the Recipient should be encouraged to voluntarily enter into a Management Development PlanFootnote 2 which identifies areas of concern and provides a plan to address the concerns;

- Recipient monitoring activities should be increased and the Transfer Payment Management Committee (TPMC) or regional equivalent should be provided with an advisory of the potential default. TPMC should be notified and remain informed until the department is satisfied with the situation; and,

- the targeted use of expert resource services is recommended to help the Recipient avoid moving into default of the Funding Agreement.

If prevention activities are unsuccessful in preventing a default the Prevention, Management and Sustainability Approach moves to pillar 2 — Default Management.

5.2.3.1 Default Identification

Information Sources

Defaults may be identified through the department's structured business processes (e.g., compliance regimes) or through less structured means (e.g., observations made during field visits). First Nations and Inuit Transfer Payment (FNITP) System provides protocols for capturing, storing and accessing both types of default information.

Informal Action

Funding Services Officers (or equivalent) monitor the default information provided by Program and compliance managers. When problematic trends are observed, they may contact the Recipient to confirm the situation and encourage the Recipient to rectify the default(s). Such (informal) action may be justified as appropriate, where two or more of the following are known to be true:

- the Recipient has a low General Assessment (GA) risk rating;

- the specific defaults are low-risk in nature;

- the Recipient is known to have initiated corrective action or has committed to do so;

- an identifiable past event precipitated the default(s) (e.g. illness or loss of staff; surge in workload, etc.); and

- reasonable justification exists for late documents (e.g. sub contractor information will not be received in time to submit report).

Formal Action not Initiated

Steps taken to contact the Recipient to confirm the situation and a decision not to initiate formal action through a Default Assessment will be noted to file.

Initiating Formal Action

Where the Funding Services Officer (or equivalent) in monitoring default information, observes problematic trends, steps will be taken to initiate a Default Assessment where:

- the nature of the default information suggests that the risk to the service population is high; or

- measures to encourage the Recipient to rectify the defaults, have not had the expected results.

Under the direction of the FSO or responsible official, a default assessment may be deemed necessary. He/she may update the Recipient's General Assessment, as a first step in initiating a Default Assessment, for the purpose of presenting to approval authorities, the range of potential issues that may impact delivery of AANDC funded Programs, services, activities and projects. Changes to the Recipient's GA risk profile may also result.

5.2.4 Pillar 2 — Default Management

The Default Management is a structured business process used to identify defaults and then determine the most timely, least intrusive and most cost effective method of remedying a default. The risk based approach of the new policy on Default Prevention and Management is less prescriptive than the previous Funding Arrangements: Intervention Policy and it can be utilized for innovative approaches to remedying a default.

There are a wide range of actions available to the department, and must be necessary, progressive, reasonable in the circumstances and must be communicated to the Recipient without limiting any remedy or other action Canada may take under the Agreement. The actions taken must be well documented and need to be based on documented fact and not conjecture.

The legal underpinnings of default management activities are contained within the text of the Funding Agreement. The range of default remedies available to the Department are also defined in the agreement and have been agreed to by the Recipient when they signed the agreement.

A default, as specified in the Funding Agreement, is the occurrence of any of the following circumstances:

- the Recipient defaults in any of its obligations set out in the current Funding Agreement, a prior agreement, or in any other agreement through which a Federal Department funds the Recipient;

- the auditor of the Recipient gives a disclaimer of opinion or adverse opinion on the financial statements of the Recipient in the course of conducting an audit pursuant to a Funding Agreement;

- in the opinion of the Department, with regards to any financial information relating to the Recipient and reviewed by the Department, the financial position of the Recipient is such that the delivery of any Program for which funding is provided under the Funding Agreement is at risk;

- in the opinion of the Department, the health, safety or welfare of the Aboriginal community is at risk of being compromised, or;

- in the case of an incorporated Recipient, the Recipient becomes bankrupt or insolvent, goes into receivership, takes the benefit of any statute from time to time being in force relating to bankrupt or insolvent debtors, or ceases to be in good standing with whichever federal or provincial jurisdiction in which the Recipient was incorporated.

5.2.4.1. Default Assessment (DA)

The Default Assessment is a structured business process used to determine, for a Recipient in a default situation:

- the risk to the service population;

- the risk to (successful) remediation;

- the overall default management (DM) risk rating; and

- a recommended default management (DM) action(s) — informed by the overall DM risk rating process.

The Default Assessment is completed in accordance with the DM User Guide, workbooks, formats and instructions issued by the Chief Financial Officer.

The overall default management risk rating classifies Recipients as having a "low", "medium" or "high" risk profile. Based on the Recipient's risk rating, the appropriate delegated authority, as outlined in the table below, is provided the DA and recommended DM action(s) for review. Such actions may or may not be accepted by the delegated authority, who may choose to provide alternatives.

| Overall Risk Level | Multi-Program (Ongoing) Recipient | Project and Specific Agreement Recipient | Approval |

|---|---|---|---|

| Low Risk | Monitored Self Correction (e.g: Ninety Day Plan for corrective strategies) | Monitored Self Correction (e.g: Ninety Day Plan for corrective strategies) | Funding Services Manager or equivalent with notification to Regional TPMC |

| Medium Risk | Management Action Plan — Expert Resource Support | Management Action Plan — Expert Resource Support | Regional TPMC |

| High Risk | Third Party Funding Agreement Management | Terminate Agreement | Program/Regional Director General |

5.2.4.1.1 Risk to Service Population

Risk to service population as outlined in the DM User Guide is determined in consideration of the actual or potential consequences of a default situation; and the degree of urgency associated with correcting the defaults.

Information about the Recipient is compared to the risk to service population "considerations" or sources of risk as outlined in the DM User Guide, to determine a risk score for each deault. The risk scores are used to prioritize corrective action. The "cumulative score for all defaults" is used to classify the overall risk to service population risk rating as being low, medium or high.

5.2.4.1.2 Risk to Remediation

Information about the Recipient is compared to the risk to remediation "considerations" as outlined in the DM User Guide to determine a low, medium or high risk to remediation rating.

5.2.4.1.3 Overall Default Management Risk Rating

The overall default management risk rating which is based upon the risk to service population and risk to remediation is determined by applying the table 1 presented in the DM User Guide — Annex: Determining Default Management Action.

A default management action is determined in proportion to the overall default management risk rating. This rating may be supplemented by the judgement of the responsible officer, who will draw upon information which may be available.

Thereafter, the responsible officer will recommend a default management action. If the recommendation differs from that generated by Default Management Assessment contained in the DM User Guide, a rationale will be provided.

5.2.4.2 Principal Default Management Actions

There are five principal Default Management actions listed in ascending order of risk to be managed and are subject to the following evaluation cycles to determine if the required results are being achieved:

- initiate monitored self correction – monthly

- withhold funds intended for services deemed by the Responsible Officer as non essential — as often as deemed prudent to manage risk

- require Management Action Plan (MAP)/Expert resource support — quarterly or more often if deemed prudent to manage risk

- Third Party Funding Agreement Management — quarterly or more often if deemed prudent to manage risk

- terminate agreement

The principal default management action(s) may or may not be applied sequentially and do not preclude the responsible officer from initiating other default actions contemplated in the Funding Agreement. This provides a level of flexibility in order to take other reasonable actions that are not specified in the agreement. A Ninety Day Plan (NPD) is an example of such measure, or making direct payment to a contractor for the completion of a critical capital project such as a water treatment plant when the Recipient defaults on payment. Default actions are applied based upon the overall default management risk rating determined through the default assessment process and accepted by the Responsible official with delegated authority (see Exhibit 1). The principal default management action may be amended upon the approval of the delegated authority in consideration of progress being made by the Recipient in remedying their default(s); and as supported by an update of the default assessment.

| Principal Default Management Action | Recommended by | Accepted by |

|---|---|---|

| Initiate monitored self correction (e.g: Ninety Day Plan) | FSO (or equivalent) | FSO Manager with notification to Regional TPMC |

| Withhold funds intended for services, deemed by the Responsible officer, as non essential | FSO (or equivalent) | FSO Manager |

| Require Management Action Plan (MAP) | FSO Manager | TPMC |

| Appoint Third Party Funding Agreement Manager | TPMC | Program/Regional Director General |

| Terminate agreement | TPMC | Program/Regional Director General |

There are four potential outcomes of the default management action evaluation process:

- remediation is not progressing as anticipated — reassessment required. The plan may be adjusted in response to changing circumstances or to improve performance

- remediation is progressing as anticipated — plan may be adjusted in response to changing circumstances or to improve performance

- remediation complete — exit strategy is applied

- remediation no longer required

5.2.4.2.1 Default Management Action 1: Monitored Self Correction

Where the overall default management risk rating is low and the Recipient is deemed capable of remedying the default(s) within approximately 90 days, on approval of the Funding Services Manager or equivalent, the Responsible Official will communicate to the Recipient:

- the option to prepare a corrective strategy to remedy the default(s);

- support that may be available to the Recipient to assist in remedying their default(s) (e.g. list of expert resources); and

- the Department's decision whether to accept the corrective strategy formulated by the Recipient.

Expert resource support can be implemented for a single or multiple Programs or be applied to all AANDC funded Programs and core administration. Expert resource support is used when the Recipient is willing but lacks the capacity to remedy a default. A Financial Manager who also exercises signing authority like that of a co-manager remains as an option under the Default Prevention and Management Policy. As funding for expert resource support is not provided by the department, a Management Action Plan should be considered prior to requiring expert resource support.

Within the corrective strategy, the Recipient will be required to set out in the format of its choice, by default or groupings of common defaults, the action to be taken and by whom within the 90 day timeframe. The Responsible Official will approach the Recipient to formulate mutually agreed upon benchmarks and will subsequently monitor progress against such benchmarks. The corrective strategy is not incorporated in the Funding Agreement as an amendment.

Within the corrective strategy framework, the Responsible Official will notify the Recipient of the requirement to prepare a Management Action Plan if any or all of the following occur:

- the Recipient declines the option to prepare a corrective strategy;

- the Recipient prepares a corrective strategy not acceptable to the Department;

- corrective strategy benchmarks cannot be agreed upon between the Department and the Recipient;

- desired corrective strategy results are not achieved within the agreed upon timeframe.

5.2.4.2.2 Default Management Action 2: Withholding of funds deemed by the Responsible Official as intended for non essential services

Once a default has been identified, the appropriate Responsible official may withhold funds deemed by the Responsible Official as intended for non essential services. Such funds would have otherwise been payable under a Funding Agreement.

Other Departmental directives authorize the withholding of funds without the undertaking of a formal default assessment process.

5.2.4.2.3 Default Management Action 3: requirement to prepare a Management Action Plan

Where the overall default management risk rating is medium and upon acceptance by the Transfer Payment Management Committee (TPMC), the Department will notify, in writing, the Recipient of the requirement to prepare a Management Action Plan (MAP). This is the least intrusive form of default management.

MAPs will be added to the existing Funding Agreement via an amendment with assigned data collection Instruments (DCI) for quarterly reporting requirements applying the templates outlined in the DM User Guide. Funds will be held under the Management Control Framework (MCF) if quarterly updates are not adhered to by the Recipient.

A self managed Management Action Plan (MAP) is used when the Recipient is willing and has the capacity to remedy the default. This is a Recipient lead activity that must be acceptable to the Department.

The following principles apply in defining MAP requirements:

- development and implementation of the MAP must reflect the risk to the service population and is to be completed within 60 calendar days;

- individual defaults or like groups of defaults are prioritized by risk level;

- to the extent possible, the MAP supports ongoing Recipients in sustaining the level of contribution authority that they exercise and innovations made to improve Program outcomes;

- the MAP is scaled to the complexity of the default situation. This may include preparation of a MAP Financial Plan where the Recipient must improve its financial position; and a MAP Capacity Development Plan where the Recipient must improve staff qualifications or skills to remedy the default;

- the Responsible Official may require that any of a series of measures be integrated into the MAP to support success in a particular situation (e.g.: use of an Expert resource, Tribal Council etc.);

- a List of MAP review and acceptance criteria can be found in the DM User Guide;

- when the Recipient lacks the capacity to develop or implement a MAP, an expert resource support will also be a requirement for MAP approval;

- the MAP may be amended by the parties in view of changing circumstances or with a view to improving outcomes;

- the requirement for a MAP may be removed where the high and medium risk defaults, identified though Notice to the Recipient, have been remedied by the Recipient;

- the MAP Capacity Development Plan may continue to be implemented by the Recipient, after termination of the MAP, to provide for longer-term stability/resilience of the Recipient and with the aim to avoid recurrence of the defaults;

- a List of review criteria for exit from MAP also exists and can be found in the DM User Guide.

5.2.4.2.4 Default Management Action 4: Third Party Funding Agreement Management

This is the most costly and intrusive form of default management and should be used as a last resort to ensure the continued delivery of Programs and services to community members. The Responsible Official will, upon approval of the Region/Program Head, notify the First Nation or Tribal Council of the appointment of a Third Party Funding Agreement Manager if any or all of the following are deemed occur:

- the Overall DM Risk Rating is high;

- governance dispute and the department cannot identify a First Nations Leadership or loss of quorum prevents business from being conducted;

- the Recipient is unwilling and/or unable to rectify its default situation;

- the implementation of the Management Action Plan, within the required timeframe or Expert resource support prove unsuccessful;

- extraordinary circumstances dictate the need for a Third Party Funding Agreement Manager.

See the Directive on Third Party Funding Agreement Management (2011).

5.2.4.2.5 Default Management Action 5: Termination of Agreement

Where the Overall DM Risk Rating is high and upon approval of the Region/Program Head, the Responsible Official will notify the Recipient, in writing, that the agreement will be terminated and the reasons for its termination.

The Responsible Official may give the Recipient up to 14 days from the time the Recipient receives the Notice issued by the Department to provide information which would indicate that a default has not occurred or has already been remedied — except where the delegated authority determines that urgent health and safety issues demand immediate action. This option is usually applied for Recipient other than First Nations.

Upon termination, the Department will:

- pay any amounts owing to the Recipient;

- cease scheduled payments;

- require an accounting from the Recipient for all expenditures under the agreement or arrange for an independent audit of such expenditures;

- require reimbursement of unexpended funding and ineligible expenditures;

- take other actions as the Responsible Official deems necessary under the circumstances to minimize impacts on the service population and protect the public's interest.

5.2.5 Pillar 3 — Sustainability

5.2.5.1 Recipient Support

Recipients often emerge from a successful Default Prevention, Management and Sustainability Approach process with increased capacity and a solid foundation for future success. The significant work completed by the Recipient as well as the FSO and POs can be utilized to achieve the vision of Leadership and move toward progressively greater independence and a sustainable well functioning community.

- AANDC encourages Recipients to engage in a process of continuous improvement and make a Management Development Plan (MDP) a part of the continuous improvement process. A MDP may contain some elements that formed part of an exit strategy from Default Management or utilize the Readiness Assessment workbook to complete a gap analysis and develop a plan to move toward a Block funded agreement.

- plans such as a MDP and similar plans are encouraged as they may enable Recipient eligibility for capacity development funding.

5.2.5.2 Other Sources for Capacity Development

The Department's Community Development Framework is an excellent way to plan for and develop community capacity. In addition, Recipients should be referred to Aboriginal Organizations that support First Nations in developing their financial, administrative and management capacity. Two such organizations are:

In addition, Tribal Councils are funded by AANDC under the Tribal Council Funding Program Policy. They are mandated to provide specific advisory services and are responsible to their member Nations for helping develop capacity. High functioning Nations are often willing to share best practices including copies of constitutions, financial and administrative bylaws and policies.

It should be noted the policies, processes and procedures developed with funding support from the Professional and Institutional Development Program are shareable with other Recipients.

6.0 Emergency Situations

6.1 States of Local Emergency

Where defaults arise when a Recipient is in a state of local emergency as declared by the responsible federal, provincial or territorial authority, the Department's response to the situation will be informed by the direction set by the responsible authority. The objective is to support a coordinated, effective response to the emergency situation.

6.2 Other Emergencies

The Program/Regional Director General may direct that the Default Identification and Default Management processes be expedited, where it is evident that an urgent response is required to manage the risk of severe negative impacts.

7.0 Oversight and Internal Controls

Additional oversight and controls support due diligence and are in place to ensure enforcement of this directive through the following activities:

- FNITP regiments the tracking of all Recipient obligations and makes relevant information accessible for default identification and trend analysis:

- risk assessment tools such as the General Assessment and Default Assessment, contain benchmarks to which information about a Recipient is compared in order to arrive at a risk profile, thereby supporting evidence-based, value-neutral, repeatable conclusions;

- review of decision documents by increasingly senior personnel, in conformance with a risk-based delegation of authority, to assess recommendations and support a consistent approach across Recipients;

- default management actions implemented through notice, as required by the Funding Agreement; and stating the cause for action.

7.1 Staff Support

AANDC will, to the extent possible, support the development of staff skills in order to meet organizational requirements including:

- staff training with respect to the transfer payment management control framework and its supporting business processes; and

- national and regional Centres of Expertise to support staff in the exercise of their responsibilities.

7.2 Oversight of the Default Management Process

Oversight of the operation of the transfer payment management control framework and transaction processing by the Chief Financial Officer and Audit and Evaluation Services.

7.3 Review/Evaluation of the Default Management Process

FNITP provides performance indicators for review/evaluation of this directive including:

- the General Assessment module provides a multi-year data base providing a risk profile at the entity and Program level for Recipients at various levels of intervention; and

- the default management module provides a multi-year data base of Recipient histories while subject to default management.

7.4 Relations with Recipient

Engagement of the Recipient in default situations including:

- respond to requests by Recipients on the department's view as to requirements of the Funding Agreement;

- timely information to Recipients as to defaults of which the Department is aware; and

- support for capacity development to adjust Recipient capacity to requirements; prior to entering into the agreement through the General Assessment process, or over the life of the agreement through the default management process.

8.0 Consequences

(What Happens when Significant Issues Arise Under this Directive?)

The consequences of non-compliance with this Directive are set out in section 6 of the Policy on Default Prevention and Management (2011).

9.0 Enquiries

For enquiries and interpretations please contact the department's Transfer Payments Centre of Expertise:

PaiementTransferCentreExpertise.TransferPaymentCentreExpertise@aadnc-aandc.gc.ca

Appendix A — References

- Treasury Board Secretariat: Policy on Transfer Payments (2008)

- Treasury Board Secretariat: Directive on Transfer Payments (2008)

- AANDC: Management Control Framework for Grants and Contributions

- AANDC: Default Prevention and Management Policy (2011)

- AANDC: Directive on Third Party Funding Agreement Management (2011)

- AANDC: Directive on General Assessment

- AANDC: Grants and Contributions Desk Book

- AANDC: Directive on Financial Reporting

- AANDC: Directive on Reporting Management

- AANDC: Tribal Council Funding Program Policy

Appendix B — Definitions

First Nations and Inuit Transfer Payment (FNITP) System: Is a web-enabled system that automates AANDC's transfer payment business processes, manages Funding Agreement information, and provides on-line access for First Nations and other funding Recipients.

Funding Agreement: Is a written agreement or documentation constituting an agreement between the Government of Canada and an applicant or a Recipient setting out the obligations or understandings of both with respect to one or more transfer payments.

General Assessment (GA): a standardized process for assessing a Recipient for the purpose of identifying potential issues that may impact delivery of AANDC funded Programs and services; and for adjusting administrative requirements in proportion to that risk, such that the Funding Agreement is managed within AANDC's risk tolerance.

Management Action Plan (MAP): Is the primary plan, developed by the Recipient, to remedy and recover from the default, to address its causes and prevent its recurrence. The MAP is also used to identify capacity gaps and resources available for successful implementation.

Program: Is a group of related activities that are designed and managed to meet a specific public need and are often treated as a budgetary unit. A Program can be a project or a service.

Recipient: Is an individual or entity that either has been authorized to receive a transfer payment or that has received that transfer payment.

Third Party Funding Agreement Management: Is a principal default management action applied by the Department in high risk situations, whereby the Department appoints a Third Party Funding Agreement Manager to manage a Recipient's Funding Agreement for a period during of time which the Recipient works to remedy the underlying causes of the default and reassume responsibility for the Funding Agreement.

Transfer Payment Management Committee (TPMC): Is a committee established within a region or sector, with governance responsibilities, to oversee the default assessment process, to approve draft default assessment reports and accept the Management Action Plan(s), MAP(s), within their area of responsibility.